In our last newsletter, we announced our partnership with Lewan Technology, part of our relaunched CU Works Technology Service. Since then, Lewan went through a brand change themselves, and are now called Xerox Managed IT Services.

In August, we discussed the client-centric approach Lewan (now Xerox) integrates into its business, as well as the scalable, “fraction-based” service offerings they provide. We found both of these aspects very compelling in partnering with the Managed IT Service company.

This month, our interview dives into the “less is more” component that seems to drive all credit unions these days. How can Xerox help credit unions specifically with this need? In addition, how can we deliver affordable strategic level services to credit unions, like assisting them with road mapping and consulting? We interviewed Xerox Managed IT CTO Scott Pelletier on doing “less with more.”

Last year, we surveyed dozens of credit unions about what is important to them. A big one was “do more with less.” How do you apply your services to a common credit union issue: they’re budget/resource constrained?

Scott Pelletier, CTO, Xerox Managed IT Services: I call it fractional consumption. What I mean by that is you either (1) don’t have the right skill set or (2) you don’t have enough time. We can fractionalize both of those. Let’s say you have two or three people on your IT team to do all the functions. But you cannot put all the potential skill sets that are available in IT on two or three people. You need Exchange Windows, Linux, servers, storage, firewalls, networking, Azure and so on. There are a million different areas. You would need at least 10 people just to have the capacity to capture the different subject matters. We can actually provide all these skill sets in fractions – and we scale it month to month as well! Our clients want their IT team to be able to go to sleep at night and take a vacation and fill a skill set gap. We complement them and make them better. We can obviously be the IT department as well if the customer doesn’t have an IT staff in place.

Our core managed IT approach is actually very unique. It’s a very complex web you have to create from a support perspective. We built our backend operational systems, so we know what coverage level we have with all of our clients. We can mix and match those in the same account, which I’m finding to be very rare. We can be fully responsible for some aspects of the IT environment and help in other areas mixing and matching our service delivery and pricing.

How do you deliver? Is it all done remotely or on-site?

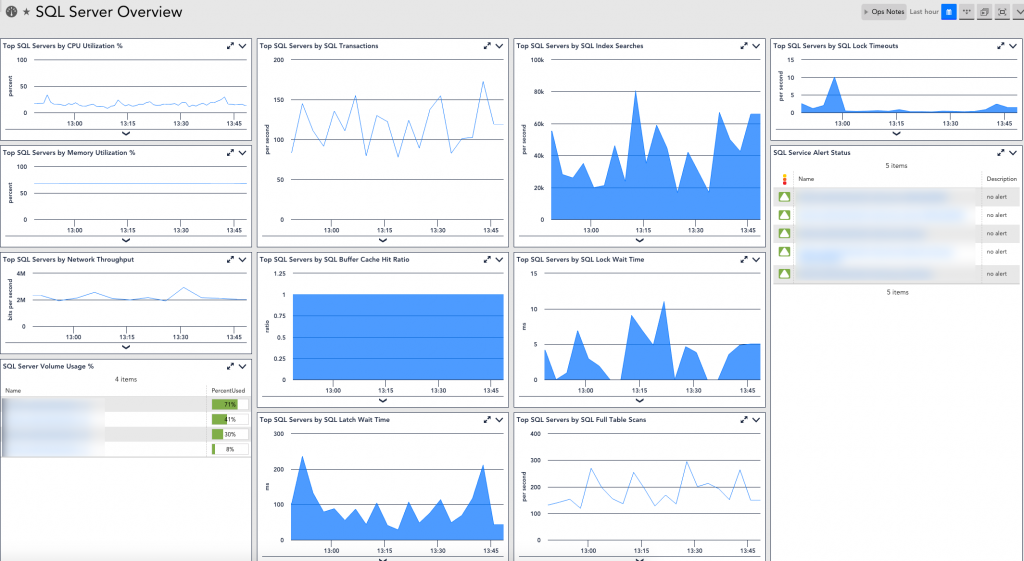

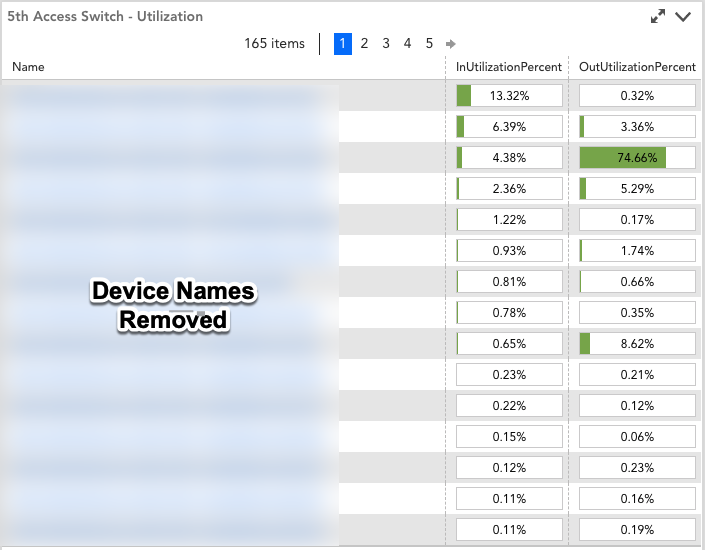

SP: That’s a good question. We do both. The majority is remotely though. Our tools and integrations have allowed us to see more of the customer’s environment and be more visible than I’ve seen any other MSP do. When we bring customers in and show them what we do, I always ask them what they can see with their current setup or their current MSP. And almost unilaterally, they say, “I can’t see much at all. I can’t see my asset information at the click of a button. I can’t see the performance of all my systems very easily. And I sure can’t see it from outside.” We tap all the portals and pull them into our system to create a master portal. We also tap other systems we have access to in order to enrich our data with data from other systems, like circuit information, warranty information, etc. That eliminates the silos of data and makes the data we have more correlated and actionable.

*Below are screenshot examples of Xerox’s client dashboards

So now, when we work on a device, we know not only the serial number and the status, but the maintenance information as well. The customer doesn’t have to give us that information. They’re surprised we’ve automatically discovered this information and associated it with their asset information.

All this leads into higher-level discussion around CIO. Talk a little bit about how this might help leverage what credit unions are trying to get done cost-effectively.

SP: We offer strategic consultants, as well as technical/tactical consultants. Sometimes clients just need a CIO/CISO to come in and help them with strategy. This links back to fractional consumption I discussed earlier. They don’t need a whole CIO. One day a month or a couple of days a quarter, whatever it is, we come in and talk to the board about what they’re trying to do, because we understand the strategy. Nice thing is, if you combine them with our client experience managers who already know your environment, we can provide a pretty clear picture of where you are, where you’re trying to go and how to get you there. We know the health, availability, performance, usage, age and almost all of the things about your environment. We can take tactical information and strategic information and then help provide a roadmap plan. We understand the strategic alignment of your business vision to your technology and how to leverage that technology to make your business better to lower your risk and improve productivity.

I really need to trust that my IT provider is visionary and can help me understand what kind of roadmap to develop for the future.

I really need to trust that my IT provider is visionary and can help me understand what kind of roadmap to develop for the future.

Gotcha. Maintenance costs or technology refreshes that are going to be happening – you still have to plan for those. That’s part of your roadmap. But to your point, you also want us to be more strategic in nature and understand where your business is going and where you’re headed and make sure we’re aligning your technology investments with those business initiatives. We have a system here called VPOSE, and it stands for vision projects, optimization, support and enhancements. it’s a lifecycle approach to achieving your vision and supporting the entire lifecycle of your technology over its life. We want to make sure not only that the technology was implemented properly but that it’s truly adopted. The ROI only makes sense if the customer is leveraging the current and future features that are part of the investment.