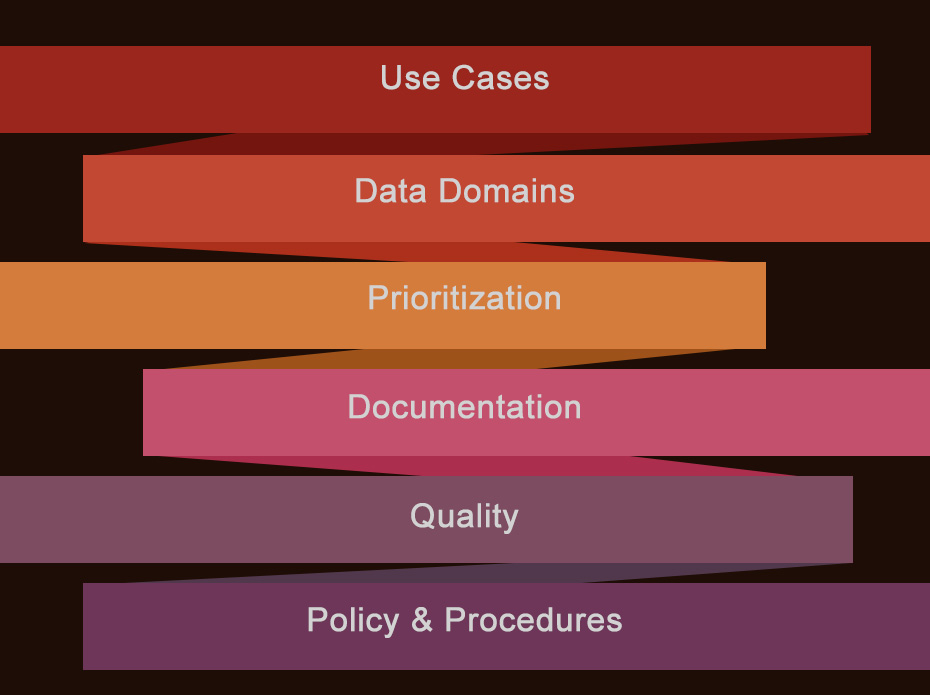

We started by simply offering Shared Branching way back in 1992, but over the past few years have changed tremendously as an organization. As a CUSO, our focus now lies in innovative back-office services that benefit credit unions and strengthen the industry for future generations.