July 25th, 2022

December 22, 2021

By Rich Nave, Aux CFO Consultant

Small credit unions continue to get gobbled up. Much has been written recently about this and the ongoing decline in the number of credit unions. Credit unions with assets less than $50M decreased by 229 to 2,582 over the past year and the trend is continuing. While these institutions face well-known significant headwinds, what is at the root of the struggle? In a word – relevancy.

Small credit unions are overall, well-capitalized but struggle to engage with and grow members and hence, eventually become irrelevant. What can be done to help small credit unions survive and thrive? Change the focus to member-facing growth initiatives, spend less time on back-office non-member facing tasks. More importantly, Director’s and Management need to address some tough questions. This will require change but change that is necessary.

Let’s look quickly at what the data shows and then what can be done so small credit unions can survive and thrive.

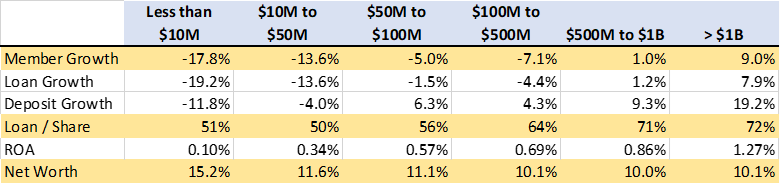

Year-over-year growth metrics for credit unions by asset size and other key ratios as of June 2021 are telling:

While the growth ratios are impacted by the shrinking number of smaller credit unions, they are very well-capitalized. They hold far more capital than larger credit unions as a percentage and far more than the “well-capitalized” threshold of 7%. Yet they do not generate the growth necessary to be relevant and grow in a financially sustainable manner.

It is no secret the headwinds that face small credit unions:

Precious time and resources spent on areas that do not help improve the relevancy of an institution leads to more mergers and the elimination of small institutions.

Strategizing and focusing on building relationships with our members and meeting their needs is of primary importance. Accomplish this in key areas:

If you agree with this so far, good! If you can’t execute, not so good. In the book, The 4 Disciplines of Execution, authors Covey, McChesney and Huling describe that the real enemy of execution is your day job. Referred to as the “whirlwind”, this is the massive amount of energy that’s necessary to keep your operation going on a day-to-day basis. It’s also the thing that makes it so hard to execute anything new. Discipline number 1 is to select one, maybe two extremely important goals to execute, instead of trying to improve everything all at once. They call these “wildly important goals”. The other disciplines are act on lead measure, keep a compelling scoreboard and accountability. 1

Change is never easy. Stepping out of our comfort zones is never easy. Human nature is to revert back to doing what we are comfortable with. But if small credit unions are to survive and thrive, it will require Director’s and leaders to grow and execute on these core initiatives.

Directors, ask yourselves:

Management, ask yourselves:

None of this is rocket science. But face these challenging questions and do some rethinking. Help is available. For starters, reach out to Aux for non-member facing tasks: compliance, data analytics, and accounting and CFO consulting services.

Smaller credit unions can survive and thrive and be an important part of the members and communities they serve.

1 The 4 Disciplines of Execution, Chris McChesney, Sean Covey, Jim Huling; 2012 FranklinCovey Co.

Rich has over 38 years of finance and accounting experience, including 17 years in the credit union industry, the last 13 as the CFO for a large credit union in New York. Prior to that Rich has held various finance positions in both publicly traded and private organizations across various industries.

Rich is passionate about helping credit unions thrive. Collaborative and service-oriented, Rich provides strategic insights and critical decision-making analytics while communicating the story behind the numbers. He is also passionate about leadership and organizational growth.