Welcome back! In Part 1, we addressed the sometimes forgotten but fundamental core concepts before diving into the planning process. These core concepts set the foundation. Refresh yourself with Part 1, which can be found by clicking here. Now in Part 2, we’ll address how we can do the hard work to ensure we develop a plan that is clear, concise, identifies the few wildly important goals and institutes accountability.

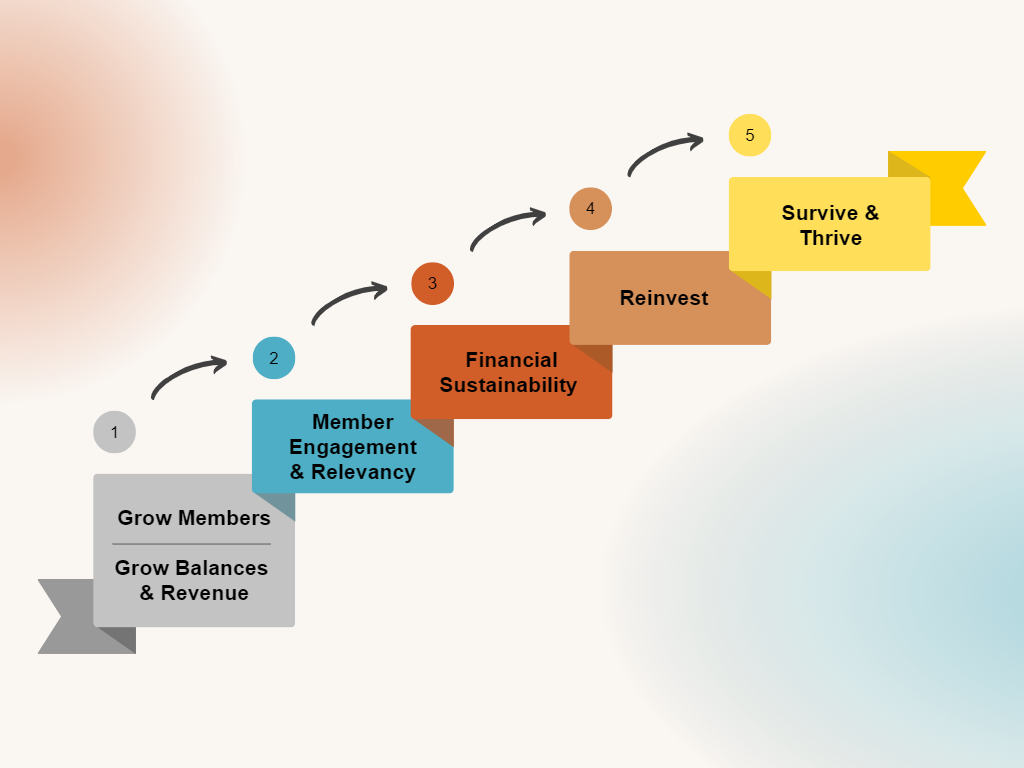

The Strategic Plan to Survive and Thrive

Of course, there are many ways to approach this, but the reality is it can and should be kept simple. We must ask ourselves the following seemingly simple yet very challenging questions:

- Where are we now?

- Where do we want to go?

- How will we get there?

These will not be easy to answer, nor should they be. It requires a healthy debate among the board and management, an honest self-assessment, and data. Take the time to ponder these questions before diving in.

Where are we now?

There are three parts to this question. The first two are easy; the third is not … at all.

- Step #1: The “Look Back”. This first easy piece is a look back at the institutions’ historical performance and trends. Are you growing in a financially sustainable manner, and how are you growing? Are you taking on more risk, or becoming too concentrated in any area? Are you trending in the same manner as your peers and the industry? How strong are member-owner product penetrations and usage? Finally, what are you hearing from employees and member-owners? What are the surveys telling you?

This is not what you think, this is what they are telling you. Pause and reflect on this wealth of information before moving on.

- Step #2: Financial Strength. The second easy piece is to have a clear understanding of the financial strength of the institution. More specifically, the net worth position and the ability to generate sufficient earnings.

Again, pause and reflect on this, and if necessary, take the extra time to evaluate what range of net worth is truly needed. Do not hoard capital from your member-owners; it belongs to them. For a method to evaluate and determine what is necessary, click here. If you have excess net worth, how will you strategically address that?

- Step #3: People, Process and Technology. The not-so-easy piece. You already have an inkling by now of where the institution needs to go and what needs to get done. Are the right people, processes, and technologies in place? If not, you have difficult decisions to face, and this may also play into helping decide where you need to go.

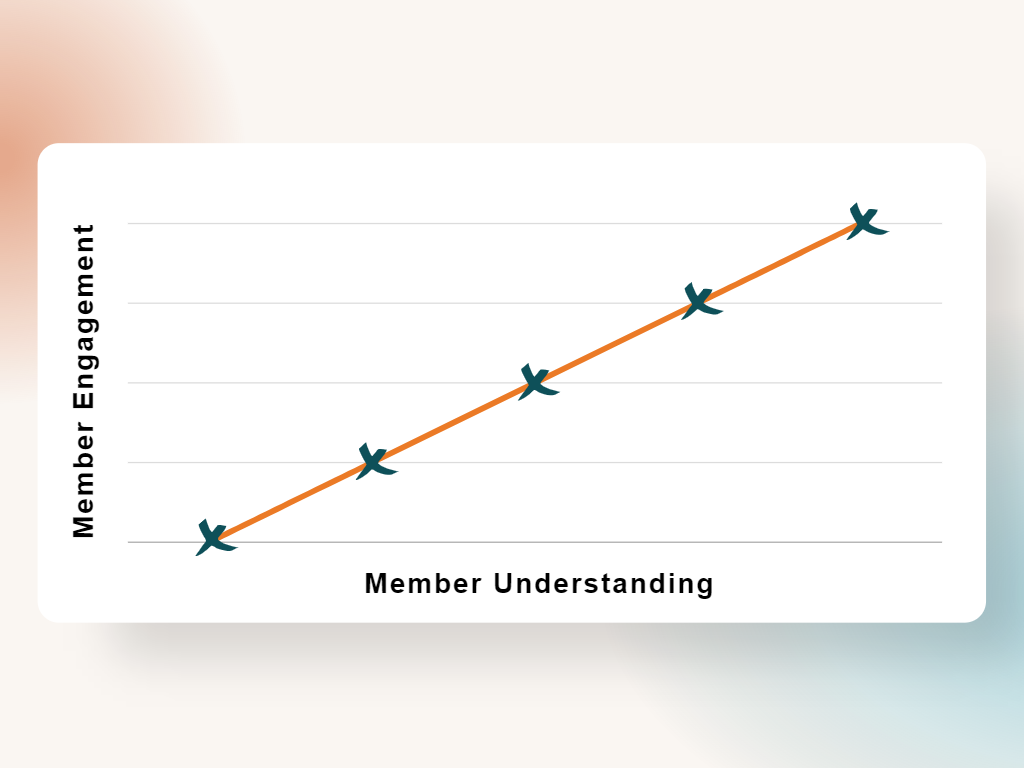

Can you now grade where your credit union lies in the following chart?

Be realistic, and if you’re not sure, repeat steps 1–3 above.

Where do we want to go?

Sorry folks, just as no two human beings are exactly alike, neither are two credit unions. Hence, we can’t offer specific plans, but we can offer the following key principles, questions and approaches:

- Spoiler alert: you will never get to the final destination; your job is never over. Taking the time to thoughtfully go through the process and learn, reflect and grow is what matters. This is all about the journey, not a destination.

- You, yes YOU, and the credit union need to listen, learn, and evolve. This is the recipe for growth, both professionally and organizationally. Did you listen to your staff and your members in Step #1 above? What was revealed to you and how will you strategically address that?

- How are you different? What is your uniqueness? Anything? Thousands of institutions offer the same products and services as your institution. How will you differentiate? Engaging and building relationships with your member-owners is always a good answer. But where specifically? Decide what member-owners, and what products and services you need to focus on.

The Roadmap to Survive and Thrive:

How do we get there?

Almost home, but not quite. Remembering “FSA” from Part 1: Focus, Scoreboard, Accountability, now it’s time to identify the very few wildly important goals and create a compelling scoreboard and institute accountability.

In the book, The 4 Disciplines of Execution, authors Covey, McChesney and Huling describe that the real enemy of executing strategies is your day job. Referred to as the “whirlwind”, this is the massive amount of energy that’s necessary to keep your operation going on a day-to-day basis. It’s also the thing that makes it so hard to execute anything new.

Discipline number 1 is using all of the hard work done thus far, identify the very few extremely important goals to execute, instead of trying to improve everything all at once. 1 These are the “wildly important goals”. Then identify and act on lead measures, keep a compelling scoreboard and institute accountability.

Management must step out of the “whirlwind” and devote critical time to the wildly important goals while continually monitoring progress. Board members must hold management accountable by monitoring the scoreboards and staying out of the weeds. It’s up to management to decide the “how”, the board is responsible for gauging the “if” and “when”.

Credit unions can survive and thrive and be an important part of the members and communities they serve. Don’t check the box; utilize strategic planning as an important process to ensure your credit union survives and thrives.