A crisis only reinforces the importance of a solid accounting function, and unfortunately, exacerbates hidden weaknesses.

2020 has been one heck of a year, and credit unions across the country have spent an immense amount of energy and focus trying to serve their member’s needs under the constraints of COVID-19. Unfortunately, there is only so much time (and brain cells!) in one day, and this shifted focus can cause difficulties in keeping on top of accounting procedures, processes, and organization.

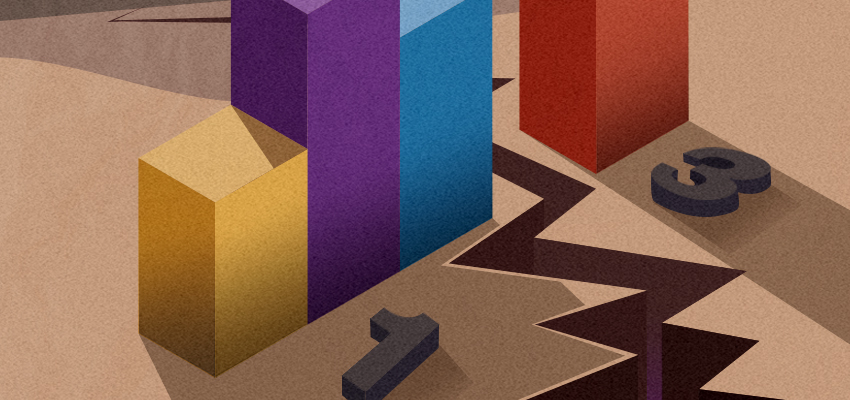

Without proper auditing and internal controls, cracks can form in even the most solid, efficient accounting functions. Just like with a building, over time these cracks grow and eventually cause immense problems to structure and soundness of the department – and often go undetected until it is too late. In this whitepaper, we identify several key accounting spots prone to cracks, including:

- Effectively Tracking of Prepaids and Fixed Assets

- Balancing Official Checks against a Check Register

- Proper handling of ACH exceptions – specifically when information doesn’t match

- Tracking Accounts Payable and Invoices

- Accounting for premium amortization for loans purchased

- Timely reconciliation of all balance sheet GL accounts, handling outstanding items and balancing to source documents

Please fill out the form below to download the whitepaper.