August 19th, 2022

November 25, 2020

By Guest Contributor Anne Legg, Data Strategist and Owner of THRIVE™

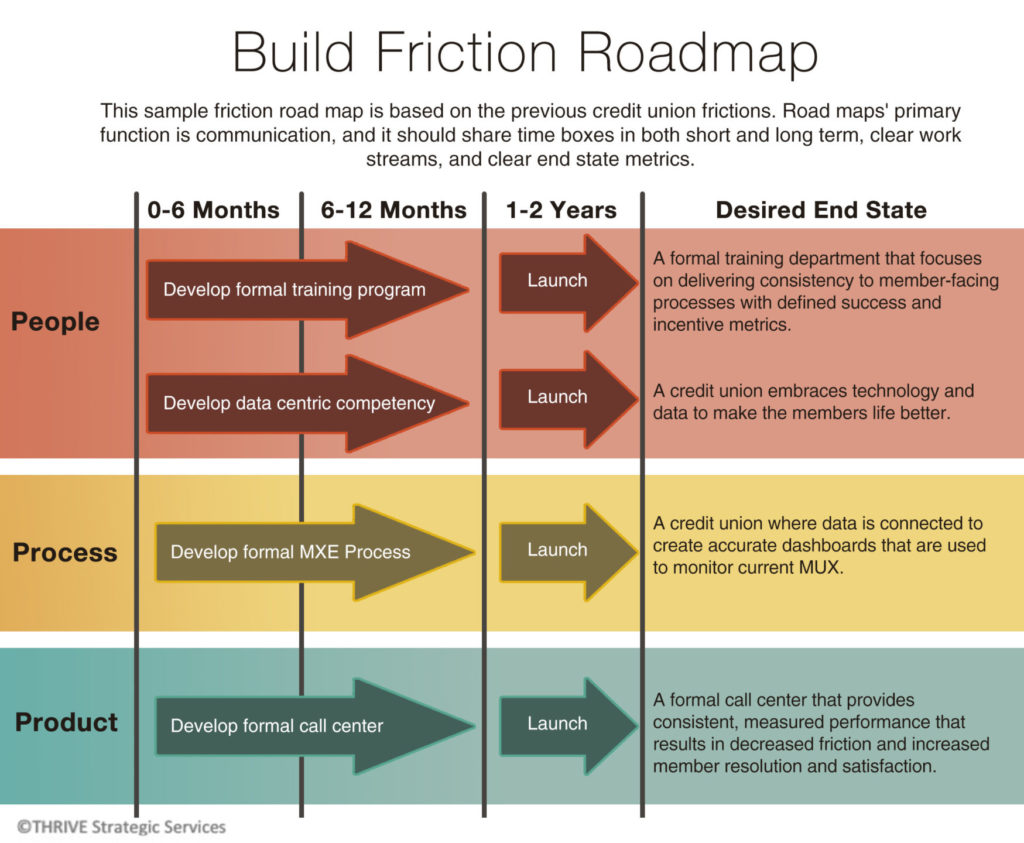

Finding ways to improve members’ lives is a foundational mantra for a credit union. While the mission is clear, the pathway may be muddy. From the member’s perspective, the member has only four problems that they want the credit union to solve.

These problems are:

Understanding the member problems provides clarity to the credit union on the process, product position, market position, and messaging and uncovers frictions.

Product frictions can be the lack of product knowledge by the user. Typical product friction is a lack of understanding regarding how a skip-a-payment affects the loan terms and how a check hold works and affects available funds.

Process frictions occur when there is friction in an overall process. Common frictions include members not being aware of the credit union option, the obstacle-filled application process resulting in abandoned carts and unnecessary length, and loan fulfillment that takes too long.

People frictions are a combination of both individual capability and culture. A legacy culture may be one that has a low threshold for change. Products, policies, and processes do not get reviewed for improvement and create a status quo culture. This stagnant culture usually breeds a capability of complacency.

Here are six common frictions in this auto purchase journey.

About the Author

Anne Legg is the founder, and principal of THRIVE™ Strategic Services. THRIVE™ works with credit unions to create revolutionary member relationships via organizational education, member-centric data strategies, and data maturity.

She is a recognized credit union business strategist, presenter author, educator with an MBA thesis on the credit union business model as well as two internationally published whitepapers on credit union business strategy. She has delivered over 100 onsite sessions to over 600 credit union senior leaders across the united states, launching their data journeys.

Anne is author of Big Data/Big Climb, the industry’s only playbook on data transformation. And she taught at the CUNA Marketing School and has acted as the subject matter expert for CUNA’s Credit Union marketing curriculum. She has also been an author to CUNA’s Environmental Scan, The Credit Union industry’s leading strategic planning guide. She has also served on various Credit Union Boards, including; CUNA’s Marketing and Business Development Executive Council, MAC, and the California and Nevada Credit Union League Public Advocacy Committee.