The State of the Credit Union Advantage—What Does it Mean Today?

February 6, 2024

For many years, credit unions have touted an advantage over other financial institutions, particularly banks. During our most recent Leadership Survey, we set out to discover how significant those benefits that once gave credit unions an advantage, translate in today’s world. We were mildly surprised.

Credit unions have promoted several key benefits that set them apart from other financials and contribute to what we have called the “Credit Union Advantage”. Since the beginning of the credit union movement, for the most part, these benefits have been clear and compelling. But, over time, the importance or relevance of things can change.

The traditional credit union benefits/advantages have included:

Credit unions are not-for-profit, member-owned organizations. Our main focus is on serving members and the community, unlike banks, which primarily serve their shareholders. Each credit union comes with its own eligibility requirements, giving members a common bond, whether it’s living in a certain community or working at a participating employer. Credit unions are governed by members democratically elected to serve on their Boards.

As cooperatives, instead of paying returns to bank shareholders, credit unions extend profits to members in the form of higher returns on deposits and savings, lower rates on credit cards and loans, competitive auto loan rates, and fewer fees.

Credit unions are tough to beat when it comes to member service. You can easily get in touch by email, phone or in person with questions about your credit union accounts. Credit unions tend to focus on relationships with members rather than just financial transactions. Plus, it’s easy to find a credit union near you.

Credit unions offer members a full suite of financial products and services, just like banks. Members gain access to online and mobile services such as online BillPay, mobile deposit, and person-to-person payment transfers. Members can also access thousands of surcharge-free ATMs as well as Shared Branches with the CO-OP network.

The best credit unions take pride in sponsoring and participating in charitable, educational, and other community events and organizations. From providing member college scholarships to supporting local non-profits, a credit union is much more likely to leverage its philanthropic impact directly in its community.

From childhood through adulthood, credit unions provide their members with the resources they need to better manage their finances. You’re also likely to find unique tools like Holiday Club Savings. Big banks, on the other hand, often focus their services and products on those that bring in the highest profit margin.

Unlike banks that compete directly with each other, the “credit union movement” grew out of a need for an alternative way for average hard-working Americas to have a greater say in their financial lives and has provided cohesion among credit unions to accomplish this for all members. Although changes to FOM rules have created some competition, credit unions still collaborate and cooperate with each other for the benefit of members.

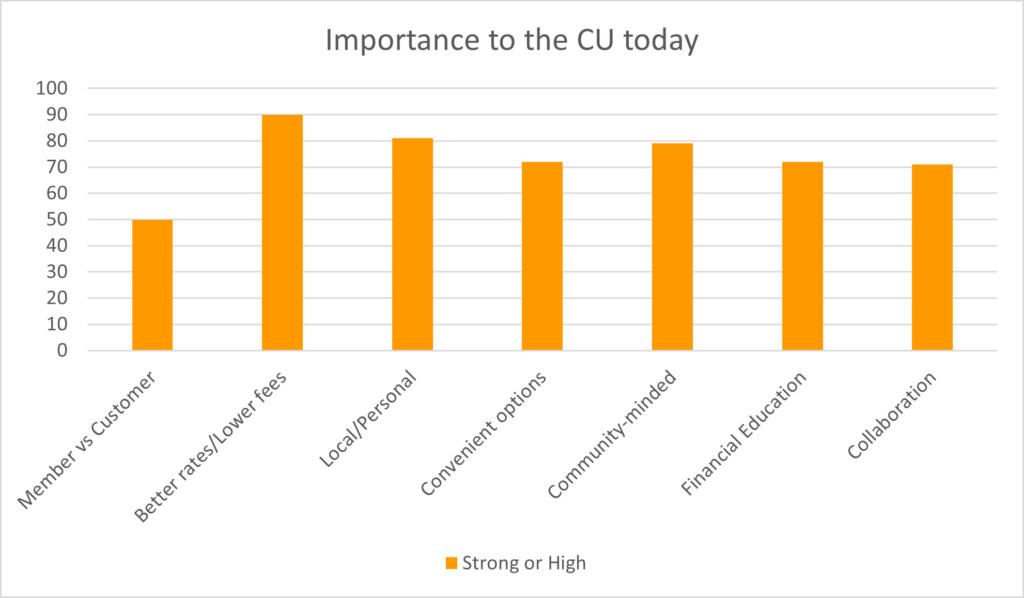

Late this past year, Aux asked credit union leaders from across the country and of all sizes three questions around each of these seven benefits/advantages. First, “How important is this benefit/advantage to your credit union today?”; next, “How relevant is this benefit/advantage for CU members today?”; and lastly, “How significant will this benefit/advantage be in 10 years?”. Their responses are summarized below.

Among the seven benefits/advantages, credit union executives ranked (strong or high importance) “better rates/lower fees” (90%) well above the other benefits/advantages, while “local/personal” (81%), and “community-minded” (79%) were somewhat less important. Least important today among the benefits/advantages were “owner vs customer” (50%), “collaboration” (71%), “convenient options” (72%), and “financial education” (72%).

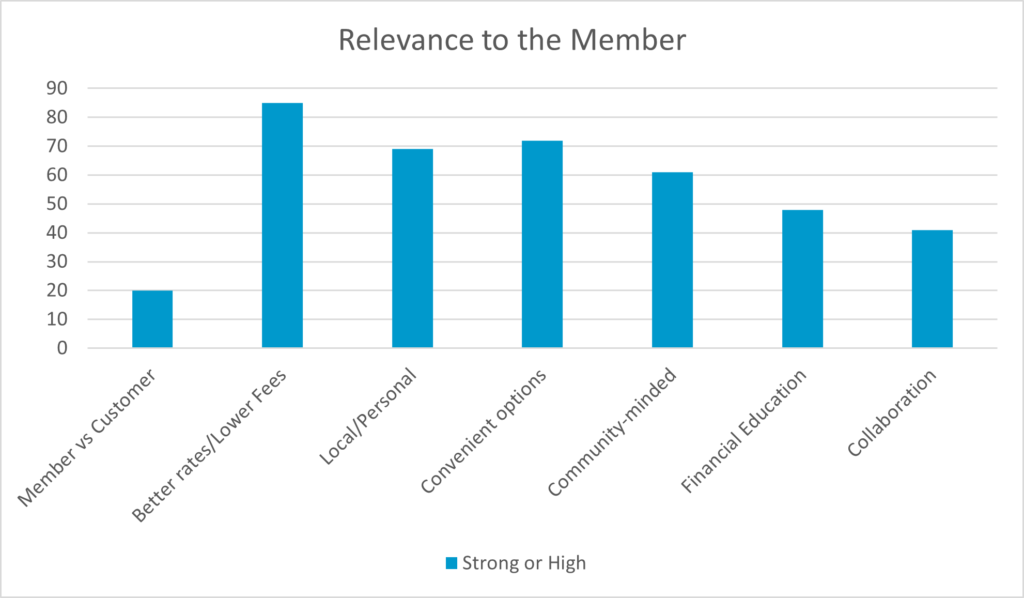

From a member relevance perspective, credit union executives again ranked “better rates/lower fees” (85%) well above the other benefits/advantages, while “convenient options” (72%), and “local/personal” (69%) were ranked lower. The lowest ranked member relevant benefits/advantages were “owner vs customer” (20%), “collaboration” (41%), and “financial education” (48%).

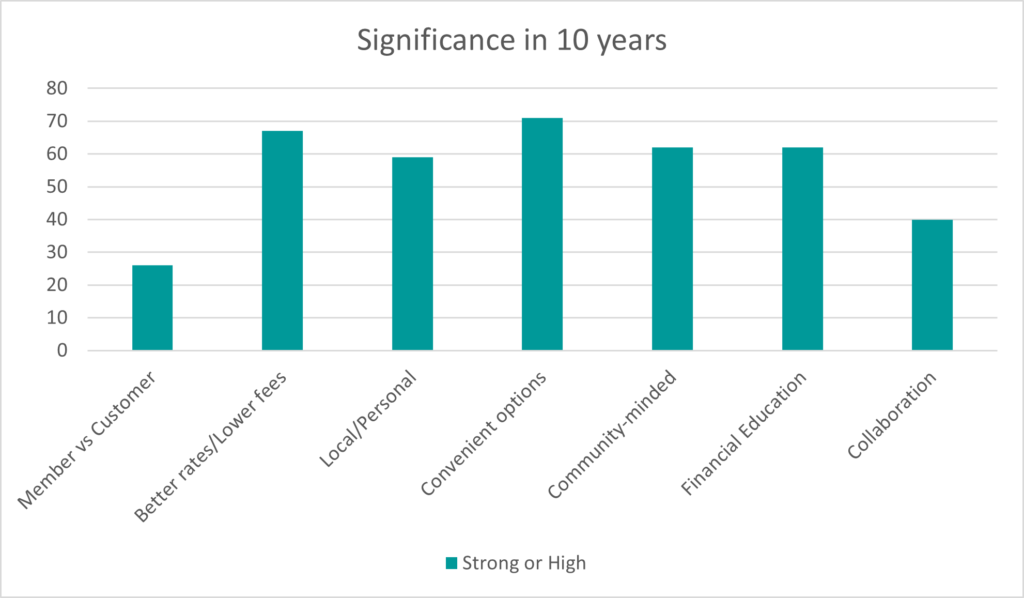

Looking out 10 years to imagine what would be the most important credit union benefits/advantages, respondents believed “convenient options” (71%) and “better rates/lower fees” (67%) would top the list. Those that ranked lowest included “owner vs customer” (26%) and “collaboration” (40%).

It should be noted that many of the benefits/advantages were rated as of moderate importance today, relevance to members, or significance in 10 years, suggesting that there are few hard edges among traditional credit union benefits/advantages. Additionally, it bears noting that among several reliable recent satisfaction surveys, banks have either matched or surpassed credit unions – another area in which credit unions once dominated in the financial services sector.

What Can We Do to Recapture a Credit Union Advantage?

The advantages that credit unions once touted and held over banks and other financial institutions appear to be fading somewhat. Uncertainty is growing around the importance and relevance credit unions have over banks and other financials today and into the future. Unless credit unions (as an industry) can find new or additional benefits/advantages over other financials, the playing field will no longer tilt towards what was once so obvious. The worst case is the industry’s survival could be at stake. Our uniqueness is at risk. It’s time to take stock of where we are as an industry and identify what is needed to create a clearer and prominent advantage…again.

We’d like to hear your thoughts on what credit unions, either individually or as an industry can or should do to reclaim the competitive advantage over other financial institutions. Share your ideas and comments with us here.

Written By: Alan Bergstrom

Alan is a passionate credit union veteran, having served as CMO for two different $B+ credit unions and as Director for TruStage (formerly CUNA Mutual Group) and its direct to consumer insurance portfolio from its launch to its successful establishment. Alan also served as CEO of a CUSO that helped small- and medium-sized credit unions compete more effectively. Alan is recognized by the CU industry as a visionary leader and top marketer. He has been trained through Filene’s i3 innovation program, named one of CUNA’s Rock Stars, received the CU Times Marketing Trailblazer award, and has been honored throughout his career with numerous prestigious CU marketing awards for his work.