July 26th, 2022

July 21, 2021

By Alan Bergstrom, VP of Marketing & Sales

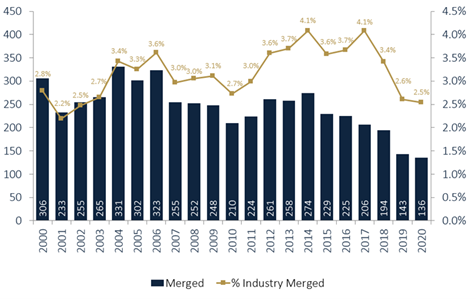

The subject of mergers has once again grabbed the headlines. As might be expected, during COVID-19, the pace of mergers dropped from pre-pandemic activity. But recently the number of planned or reported mergers has started to climb again. The latest data indicates as many as 170 credit unions could be merged in 20211.

In 1990, there were 12,891 credit unions in the U.S.2 Today, the NCUA claims there are 5,068. At one point not so long ago, the industry was experiencing almost one merger a day. And if mergers continue at a rate close to what we are seeing again, within 10 years there may be fewer than 3,000 CUs left3.

In some cases, mergers make sense. And of course, some credit unions are literally forced to merge by NCUA directive due to financial mismanagement or failing performance. The number of forced mergers, however, is low (less than 10%). Certainly, some larger credit unions include mergers as part of their strategic plan and actively target credit unions for takeover—it is part of their growth strategy—a relatively easy and cost-effective way to add members, assets, and loans. After all, as the argument goes, whatever is in the member’s best interest is the right thing to do.

There are many valid reasons to consider a merger. The cost of introducing digital technology that your competition offers but you do not have the resources to accommodate, is one of the most compelling reasons to connect with another credit union partner that either already has that capability or has the resources (solely or when combined with another/others) to provide those technologies to members. Digitization of financial services (mobile deposit, person-to person payments, online banking, mobile transactions, etc.) is quickly becoming table stakes to be in the banking business.

Credit unions that have a similar common bond SEG membership base, like healthcare workers or teachers, for example, might be another reason that makes good sense. These credit unions know their membership’s needs with precision and the products and services they offer are most likely geared toward the same member audience.

Or perhaps two credit unions share the same problems around growing their membership base and can reasonably argue that by combining forces, together they can offer that products and services that members of both credit unions need.

Sometimes credit unions may not be able to recruit or find the right talent to lead the credit union into the future. Many smaller credit unions may have a difficult time finding skilled and knowledgeable executives that are willing to accept compensation that might be less than what the market is willing to pay for them. Smaller credit unions may have been led by an executive or CEO for years and have failed to groom someone capable and willing to step in when the CEO is ready to retire.

Of course, there is the example mentioned earlier, where a credit union has failed financially and the regulators step in and force the credit union to merge—that would be the most dramatic reason for needing to merge.

Merging for the sake of merging, or because everyone else is doing it or it seems inevitable is not always the best reason to merge and might be taking premature action when a merger might not be necessary. There are a few other reasons some credit unions decide to throw in the towel and “give in” to merging—however, not all lead to merging as the best answer or solution, even for the membership.

There are situations where the credit union’s Board of Directors has not changed much in composition over the years and becomes tired or “burned out” and lacks the ability to attract new, more passionate, and energetic directors to step in and oversee the credit union’s opportunities and operations.

Sometimes, there are situations where executive talent leaves unexpectedly and the credit union’s operations and ability to carry out ongoing operations are compromised. The CEO and/or the Board of Directors may panic and conclude that the credit union needs to merge to survive.

Then there is the proverbial “golden parachute” that some credit unions use to entice a CEO to merge by offering a big payout if the CEO convinces its Board that a merger in in the credit union’s best interest. Fortunately, the NCUA has enacted a few rules that prohibit big financial rewards to departing credit union execs during a merger. Unfortunately, some credit unions have found creative ways around these rules to encourage mergers that might not be necessary or entirely justifiable.

The merger siren song of the larger credit unions can seem irresistible and even make it seem hopeless—that merging is the only solution or option to survive or serve your member’s best interests. However, quite often the merged credit union ends up losing more than it gains—from its identity, culture, locations, employees and even its members, despite promises from the “surviving” credit union that none of those things will happen.

But, before walking down the carpet to a merger marriage, credit unions must explore and evaluate all options that preclude merging and potentially dealing their members an outcome that is not always in their best interest or that of the industry. Again, to reiterate, some mergers do make sense, but too often the process of considering the right reasons for a merger are cut short or influenced in ways that are not always valid.

As our industry continues to shrink at a rapid pace—some of it for good reasons, others for the wrong reasons—our voice and diversity is at risk of being compromised. With more voices, the volume is stronger and louder than with fewer. The credit union movement was originally founded and based on a philosophy that individuals, our members, could and should have a voice and some control in how their financial lives and futures were determined. This came as a direct result of the failure of the banks during the great depression. Many hard-working individuals and families lost everything when the US banking system collapsed. Out of that collapse, in 1934 the Federal Credit Union Act was signed, giving individuals the ability to organize credit unions as cooperatives, owned and managed by the people who formed and “joined” them, not some big investors or banks, organized and structured to make profits on the backs on their depositors and borrowers. Credit union profits were designed to come back to benefit the member-owners of the credit union.

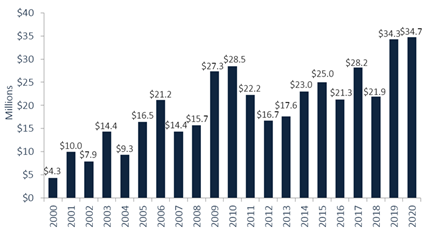

The fewer and larger credit unions become, the less “voice” individual members have in their participation with the credit union. As mergers continue, it is possible that we could eventually end up with a few large mega credit unions. And the more credit unions become like banks, the harder it will become to defend the cooperative and democratic principles on which we were founded. The average size of merged credit unions confirms that mostly smaller credit unions are merger targets.

As the argument goes, if it looks like a duck, walks like a duck, and sounds like a duck, then it is a duck. The banking industry commits millions of dollars each year attacking credit unions and trying to force legislation that would negate our not-for-profit status and diminish the position and mission that credit unions provide in serving the underserved, as an important partner in their communities, and existing as an alternative to for-profit banks.

$193M Tucson Old Pueblo CU (TOPCU) is a powerful example of the impact a credit union can have on a community. Located in southern Arizona, they have been instrumental in helping the underbanked, especially during COVID. When most financial institutions in the area closed their lobbies or offered “drive up only” services, those without cars or internet devices—primarily underserved, immigrant families—lost access to their money. And more people than you would expect were impacted. TOPCU never closed their lobby, becoming a critical hub for the community. Smaller credit unions tend to adhere more to the original core principles of the credit union mission. There is power in numbers and advantage in having a mix of all sizes of credit unions.

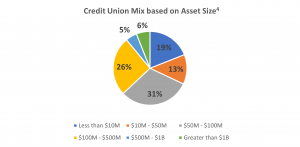

We need to find ways to help smaller credit unions survive and thrive—it is in the best interest of the movement and our industry. The current mix of credit unions by asset size may look quite different than many assume. Far and away, most credit unions are classified by the NCUA as either small- or medium-sized4.

89% of all federally insured credit unions are under $500M in assets. How much more consolidation through mergers is healthy? Is the current mix by size appropriate for the strength of the movement? What is the best mix for the health of the industry? According to Filene5, “As small credit unions disappear, it will be harder to show fulfillment of legislative intent to serve those of modest means.”

It’s no doubt, smaller credit unions face unique challenges that larger credit unions do not, often making it more difficult to operate as successfully as larger credit unions. But that is not argument enough that mergers are the only option. CUNA’s recently published The State of Small Credit Unions Today report6 identifies many of the struggles smaller credit unions must address, recommendations on what to do, and the need for the industry to help. Specifically, the report calls out these six big challenges: technology, Board leadership and engagement, member growth, generating income, health care costs, and increasing overall costs.

Surprisingly, smaller credit unions have roughly the same operating expense ratio as larger credit unions, meaning most are not in financial distress. Smaller credit unions can find ways to deal with their unique challenges and remain viable, healthy, and productive contributors to the members and communities they serve. Take, for example, $176M Reliant Credit Union near Yellowstone National Park in Wyoming. In 2019, they joined the Shared Branching network after seeing value in convenience for their membership. They are not only surviving but offering new services and strengthening the bond with their membership.

$103M Siskiyou Credit Union in northern California is another example of a small credit union making great strides. They have recently surpassed the $100M asset mark and are building a new, larger branch. Struggling to find a CFO in 2020, they embraced a collaborative mindset and partnered with Aux’s outsourced accounting services.

This example leads me to my next point: smaller credit unions must collaborate with others to gain access to technology, best practices, and expertise that alone they might not either be able to afford or benefit from. They must also economize by seeking lower cost alternatives to talent, expertise, and solutions. For example, outsourcing certain operations to CUSOs who share or spread the cost of services among several credit unions creating economies of scale can save money and provide a higher level of expertise. Smaller credit unions must revisit their Board composition and tenure and find new and creative ways to involve other members in governance of the credit union, with a focus on better strategic planning, finding ways to grow and retain membership, and staying involved and connected with the communities they serve. At the end of the day, despite the potential cliché stigma, it is about “people helping people”. The credit union difference is alive and well. We must all work hard to maintain and defend it!

There are several organizations and service providers that can help smaller credit unions avoid merging and to survive and thrive in today’s wild and wooly environment. From the State Leagues, to CUNA, to CUSOs and other special groups and committees designed specifically to assist with many of these challenges. Ask others, research organizations and available resources online, and participate and be active in State Leagues and chapter meetings. You will be surprised at the help you may find.

Alan Bergstrom is VP, Marketing & Business Development for Aux. He has worked within the credit union industry for over 15 years. Prior to joining Aux, he led Exclamation Services, a CUSO based in central Wisconsin that was focused on helping small- and medium-sized credit unions with Marketing, IT and HR services. Previously, he served as the Chief Marketing Officer and SVP of Strategic Development for two $Billion+ credit unions. His passion is finding ways for smaller credit unions thrive and survive in a rapidly changing and competitive financial landscape.

Sources

1 CUNA Mutual Group, Credit Union Trends Report, June 2021

2 NCUA

3 Filene report, Trending: Credit Unions in 2025, Filene Research Institute, Publication #376 (9/15)

4 NCUA

5 Filene report, Trending: Credit Unions in 2025, Filene Research Institute, Publication #376 (9/15)

6 CUNA, The State of Small Credit Unions Today, Final Report to the CUNA Board of Directors & CUNA Advocacy Committee, May 2021