Introduction

In this case study, we’ll discuss the journey of a full-service accounting relationship, including:

- The catalyst for outsourcing

- Unexpected benefits

- The importance of communication

- Letting go of fear and trusting professionals

- Succession planning

Before LeNoir entertained the idea of outsourcing his accounting function, he had a traditional setup consisting of an in-house, non-CPA accountant, capable of handling the day-to-day routine and monthly reporting as well as a group who managed individual pieces of the accounting function (like general ledger, accounts payable, income statement, and profitability.) After Gulf Coast lost their primary accountant to another company in late 2019, they hired a replacement, who was unfortunately not nearly as capable. This all-too-common situation created a huge disruption in the credit union’s function and created a frustrating knowledge gap, and it became evident to LeNoir that he needed a different solution this time around. He started looking immediately.

A Single Source Solution

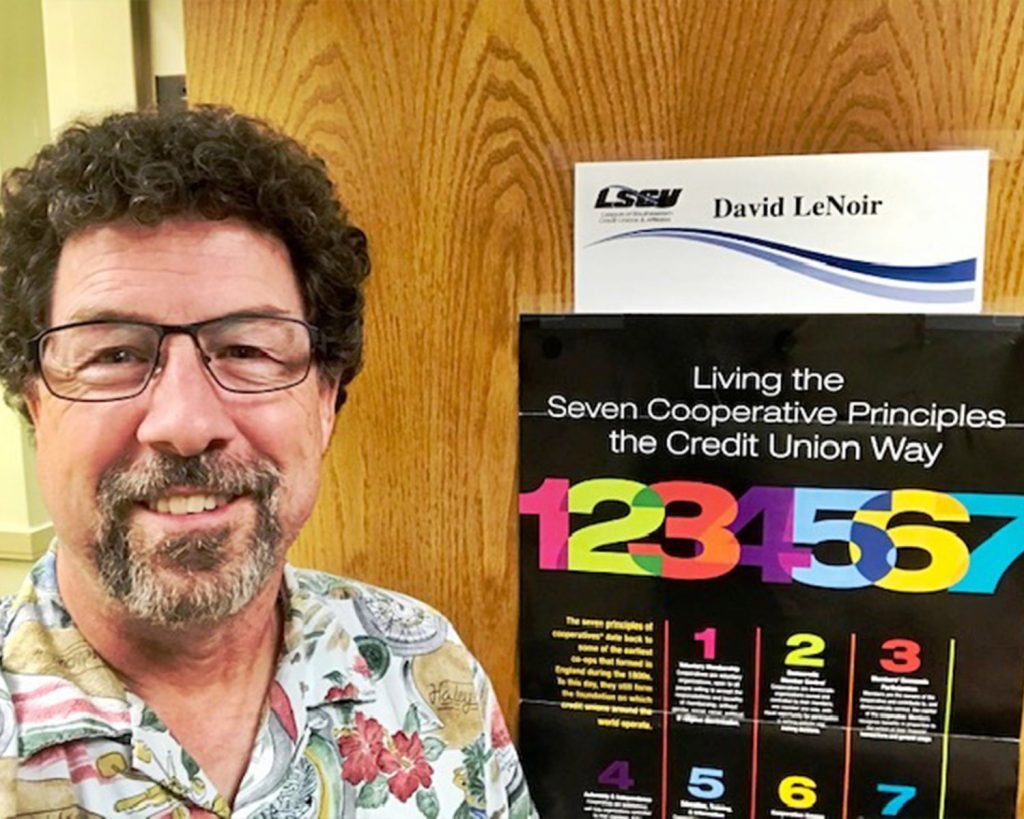

LeNoir went to his league first for suggestions, The League of Southeastern Credit Unions, headquartered in Tallahassee, Florida. He had worked for them for seven years and knew they were a great resource for tough situations and questions. Fed up with the run-around, Gulf Coast desired an alternative to hiring that would make their accounting function more economical, improve centralization of the team, and improve accountability. LeNoir explains: “When I asked the League, they said, ‘Well, we do know of some outsourced accounting firms.’ I called a dozen different ones and told them what I needed: a full-service accounting firm that can take care of everything from soup to nuts. I always got the same response: ‘Well, send us the reports you want us to prepare, and we’ll see what we can do for you.’”

LeNoir was “wholly unsatisfied” with the lack of a robust, turnkey solution. It seemed his only option was an ad-hoc combination of separate bookkeeping services and CPA services. “Our credit union needed a single source for our accounting function, one that understood credit union specific accounting, and one that was not going to rely on our own personnel to augment what those accounting firms did.” LeNoir was relieved after meeting with Diane Parham, CFO of Aux and head of the CUSO’s outsourced accounting services, learning that her team could offer a full, credit union-centric solution, one that works as an extension of his own team. “There was no other singular solution company that offers anything like that,” says LeNoir.