Data Analytics in Post-Pandemic World

May 4, 2022

In March of 2022, we finalized our findings from a nation-wide credit union executives survey on the importance of data analytics in a “post-pandemic” world. Most experts and organizations alike believe the COVID-19 pandemic has finally reached a level where it is no longer a “pandemic”, but rather an “endemic”. That means credit unions and other organizations are returning to business as usual (or “normal”—at least the “new normal”). Prior to the pandemic, data analytics was at the top of the priority list for credit unions seeking to leverage member data to improve decision-making, performance, and deliver an enhanced member experience. When COVID-19 hit, many credit unions hit the pause button on plans to implement a data analytics solution. Now that two years have passed, Aux set out to uncover (or rediscover) the importance of data analytics—to see if it still ranks high on the list of credit union projects and investments to improve performance. Thirty credit unions of all sizes and from all parts of the country participated in this survey which included nine questions surrounding the state of data analytics today. Below is a summary of that survey.

Below are the participant statistics:

- Timeframe:February to March 2022

- Sample Size:30 credit union decision-makers

- Asset Range:$50M to $4B

- Distance span:Portland, Maine to Whitefish, Montana

As one would expect, responses were varied and reflective of size, location, and membership demographics.

The Importance and Status of Data Analytics

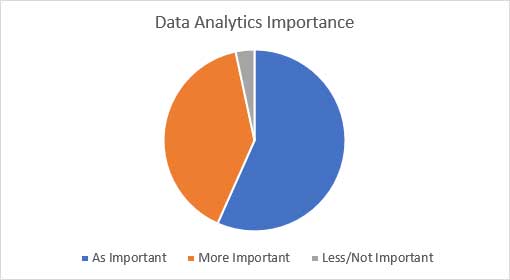

There was overwhelming agreement (97%) that data analytics is as important or even more important than it was pre-pandemic. When asked the open-ended question: “Is data analytics as important to you now as it was this time two years ago?”, the responses ranged from “not as important, too many other issues” (one respondent) to “yes, just as important” (17 responses), to “more important than before” (12 responses).

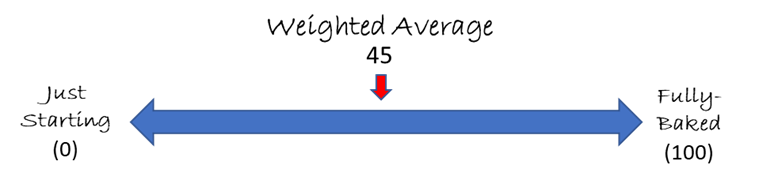

In terms of where credit unions are with respect to their data analytics strategy, most credit unions still lag where they thought they’d be by this time. The COVID-19 pandemic appears to have disrupted/delayed plans they had originally made two years ago. Aux asked participants the question: “Where is your data analytics strategy now compared to where you thought it would be in 2022 (pre-pandemic)?” On a scale of 0 (just starting) to 100 (fully baked), the average weighted score was 45. Six credit unions responded with a ranking above 75 (two ranked themselves at 100), while seven responded with a ranking of less than 25 (two ranked themselves at 0).

Future Data Analytics Plans and Expected Outcomes

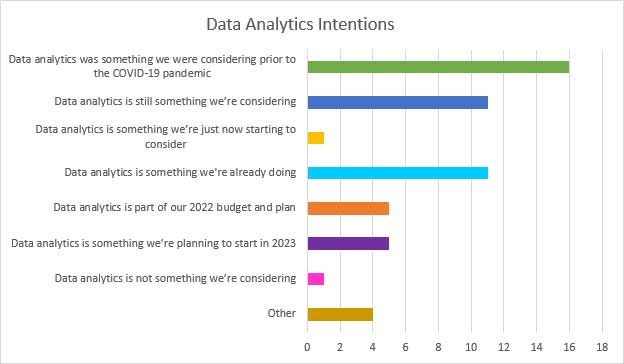

The next question asked was around the intentions that credit unions had for pursuing a data analytics solution. Respondents could choose more than one answer. Based on the responses, credit unions are either still considering implementing a data analytics solution or have already started the process. It’s evenly split for those who have budgeted for data analytics in 2022 or 2023. Only one respondent said that they were not planning to do anything with data analytics (they simply couldn’t afford it).

The next question asked was around the intentions that credit unions had for pursuing a data analytics solution. Respondents could choose more than one answer. Based on the responses, credit unions are either still considering implementing a data analytics solution or have already started the process. It’s evenly split for those who have budgeted for data analytics in 2022 or 2023. Only one respondent said that they were not planning to do anything with data analytics (they simply couldn’t afford it).

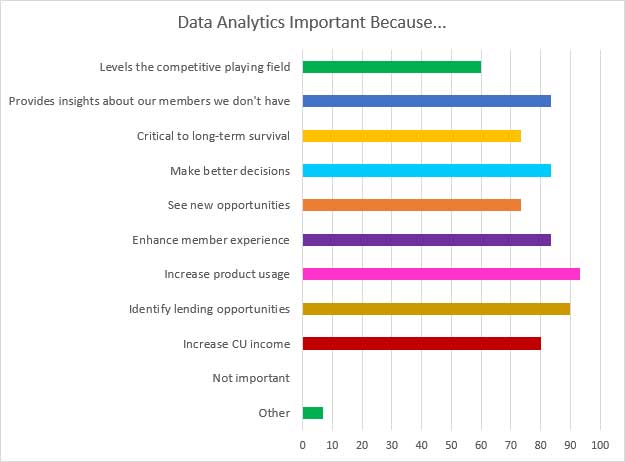

Aux also asked what credit unions expected a data analytics solution would provide for them once implemented. All credit unions agree that data analytics would provide some benefit or positive outcome. While almost every option elicited a high number of responses, several were selected by almost all participants. No credit union responded that it was not important or not necessary. The highest responses were that it could help increase product usage (93%), or that it could help identify lending opportunities (90%). Other high response rates included that it could provide insights about members that they don’t have today or would require a lot of manual effort to assemble, that it would help make better decisions about member needs, and that it would enhance the member experience (all 83%).

Implementation Reservations, Concerns and Needs

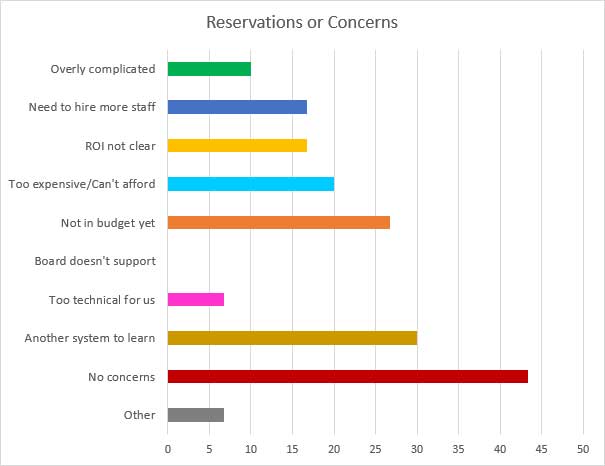

Aux then asked participants if there were specific reservations or concerns among credit unions about moving forward with a data analytics solution. 43% had no current reservations, but among those who did, the largest impediment was that it would be another system they’d need to learn and incorporate (30%). A close second was that it was not in the budget yet (27%). Other responses ranged from data analytics being too expensive or unaffordable (20%) to it being too technical to accommodate (7%).

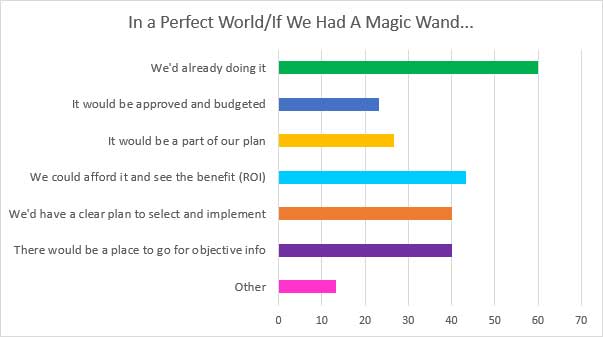

Lastly, Aux asked what credit unions would do about data analytics in a perfect world or if they had a magic wand they could wave. Not surprising, the vast majority would already be doing it (60%). It appears that affordability and a clear ROI are also very desirable (43%). Having access to planning resources and objective information is also high on the “wish” list for credit unions struggling to act on selecting and implementing a data analytics solution (40%).

Conclusion

Even though it may not be talked about as much as it was prior to the pandemic, data analytics is still as important or perhaps even more important to credit unions than it was prior to COVID-19. While credit unions are seeking to make up for lost time, many have clear reservations and concerns about how to select the right solution for their needs and to be able to access information that is objective and not biased toward a particular solution. They want to know they are investing in a solution that will provide the kinds of return and results they believe are possible through leveraging their member data. The credit union industry must find ways to help credit unions sort through the available solutions so that credit unions and their members truly benefit from the myriad of data available and utilized to improve performance and enhance the member experience.

Aux is committed to providing real primary-source data for the credit union industry to utilize. We believe it is part of our mission to help create a meaningful dialogue on critical issues facing the credit union movement by surfacing insights and stimulating new ideas. Every quarter, we intend to field a survey that probes and generates responses to issues that could positively or negatively impact the industry.