What needs to be done to get on track

When those credit unions who indicated they were behind their goals for 2022, open-ended response for what they thought they’d need to do to get back on track were insightful. Responses included:

- Most likely we’d need a merger to achieve the results in areas we are falling short;

- Decrease turnover and increase productivity;

- Grow loans at a faster pace;

- Use a different approach to gain sponsor companies;

- Additional advertising/marketing budget to successfully complete a membership drive;

- Add high quality engaged employees;

- Better technology;

- Would need to acquire other credit unions to achieve membership growth;

- Grow more deposits;

- Retain existing members who pay off loans while increasing new members. Need to increase our income to increase net worth…improve and increase loan sales;

- Create new loan products, better educate our members, and capture low-hanging fruit;

- Get the word out about who we are and what we can do;

- Increase non-interest income and increase interest income through loans and investments;

- Attract more new members and deposits;

- Get more deposits so we can purchase higher-yielding investments.

Impact on operations and growth plans of a changing economy

When asked about the potential impact of inflation and higher interest rates on credit union operations for 2022, most felt that it would have a moderate negative impact (31%).

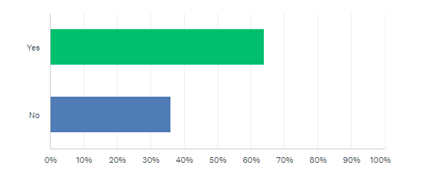

Most respondents also felt that retaining and attracting talent in today’s environment would impact their growth plans (62%). The majority of credit unions also have already had trouble retaining and attracting talent in the wake of COVID (81%). The labor shortage issue has affected credit unions’ bottom line, as well. Retaining and hiring employees has resulted in the need to increase wages and/or benefits for employees. 96% of respondents acknowledged that employee expenses have increased since COVID. As a result, 56% of credit unions have considered or are considering outsourcing some of their back-office functions to save money or acquire the talent they need. The top areas of consideration for outsourced support include HR (highest %), followed by IT, marketing, accounting, compliance, and data analytics.

Competitive landscape – today and tomorrow

In a banking landscape that is changing, credit unions find themselves competing more than ever before with each other (72%). When it comes to competing with banks, most believe they can compete effectively and fairly (80%). Some of the reasons cited for this confidence in credit union vs bank competition includes digital banking access which has leveled the playing field, continued lower interest rate loan offerings from credit unions, member (and ownership) focus, and the local, community approach to how credit unions market and do business.

Looking to the future, some credit union executives believe the industry must continue to upgrade technology, focus on the personal aspect of the relationship with members, keep wearing “the white hats” in the world of financial institutions, stay community-focused, get better at marketing our unique differences and advantages versus banks, and become more flexible and responsive to the market’s and member’s needs. There were some responses that suggested changes at the regulatory and oversight level, including more protection and attention to the needs of smaller credit unions, easing of the regulatory burden, greater incentives for collaboration and cooperation among credit unions from states and the national level, consistent exams, and a recommitment to the founding principles of the credit union movement.

Finally, when asked the degree of impact a range of economic developments would have on their credit union, the results were not completely surprising. There were five developments that elicited a high level of impact response—they included the Fed raising interest rates, the rising cost of consumer goods, inflation, FOM expansion opportunities, and potential loss of the CU tax exemption. Those developments that signaled a moderate level of impact included the loss of ODP fee income, the war in Ukraine and the implementation of CECL. Lastly, those developments that could have only somewhat of an impact included the introduction of cryptocurrency, COVID, approval of cannabis banking, student loan debt relief, and mid-term elections.

Aux is committed to providing real primary-source data for the credit union industry to utilize. We believe it is part of our mission to help create a meaningful dialogue on critical issues facing the credit union movement by surfacing insights and stimulating innovative ideas. Every quarter, we intend to field a survey that probes and generates responses to issues that could positively or negatively impact the industry. We appreciate those credit unions who participated in the survey, and we encourage others to complete future surveys on issue that impact the entire credit union industry. Complete anonymized results are provided to those who complete the surveys.