July 26th, 2022

April 22, 2021

By Alan Bergstrom, VP of Marketing and Sales at Aux

The pandemic delivered a shock to normalcy. It has been a little over a year since our world was turned upside down. Nobody saw it coming so the reactions have been difficult for many credit unions, to say the least. There are commonalities that all credit unions have faced—slow or declining membership growth, fewer loans to members, higher deposit balances than normal, tighter margins, and the potential for higher levels of delinquencies, charge-offs, and fraud—making for a difficult past 12 months. Now that there are signs that things may be on the verge of turning the corner soon signaling and end to the pandemic and its devastating effects, its time to rethink how we emerge from COVID-19’s malaise. Our cooperative spirit and practices have helped the credit union industry minimize some of the pain. It is also what will help propel us into a good recovery. As we move into recovery, it will be important to continue to spend less and become more efficient in how we do things—as we learned reducing or holding the line on spending was one area, we had some control over.

We all know that credit unions succeed by making good loans, attracting deposits, and keeping members happy. Everything else are core business functions that all businesses require. We are talking about things like accounting, compliance, and data processing, to name a few. These back-office functions, while key to running the business, are “table stakes” for any credit union. Since we all need them and they essentially are the same in how they are performed, why not try to economize, and eliminate the duplicated and unique cost of doing these things. It’s no secret it requires significant budgets to hire, train and pay the salaries and benefits for individuals who perform these functions—perhaps scarce resources that could be better applied and spent doing what credit unions must do to be financially successful—make loans, attract deposits, and deliver a great member experience. That’s where CUSOs can help!

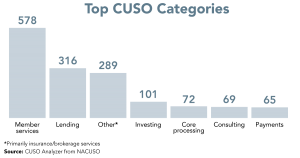

CUSOs (Credit Union Service Organizations) are corporate entities that are owned by either federally chartered, federally insured, or state-chartered credit unions—they are part of the credit union movement and share the same cooperative spirit as credit unions do. The CUSO concept has been around for about 50 years—yes, that’s right—50 years. Today, there are nearly 1,000 registered CUSOs in the U.S.

You may be familiar with a few large CUSOs—PSCU, CO-OP, MDT, among others—who don’t always tout the fact that they are CUSOs. Some started small and have grown over time to become large vendors to the credit union and financial services industry. CUSOs come in a variety of sizes and shapes—some focus on specific product and services, for example IT, or credit card portfolio management, or mortgage underwriting and servicing. Large or small, CUSOs were started to provide special benefits to credit unions.

CUSOs care about the credit union movement because they are part of that movement–they focus on and understand the needs and practices of credit unions. They exist to serve the unique needs of credit unions and are typically run by people from the credit union industry. Through the cooperative framework, credit unions can access these services without having to spend precious resources to develop them within their own credit union—essentially tapping into a “shared resource” model.

By utilizing the services of a CUSO, money spent on products or services remains in the industry and helps with the mission of “people helping people”. Alternatively, by utilizing non-CUSO businesses, you are enriching these for-profit vendors who are not part of the credit union movement.

Rather than focusing solely on profit, CUSOs focus on the economic well-being of credit unions and their members. CUSO products and services are usually designed specifically for credit unions by credit union professionals. The cost for services is typically lower from a CUSO than on the open market and your ability to work collaboratively as true partners is normally much greater in a CUSO than in other for-profit businesses. Many credit unions are already benefiting from CUSOs, saving time and resources that can be applied more effectively for the benefit of its members.

Since COVID-19, credit unions of all sizes are finding it more difficult to stay on top—providing members with competitive products and services and controlling expenses across the organization. At Aux, a CUSO that has been serving credit unions for nearly 30 years with over 50 credit union owners, we are committed to helping all credit unions survive and thrive. By offering back-office services in the areas of accounting and finance, compliance, and data analytics, we can help save money and create a competitive advantage—just as we have been doing for more than 200 clients. Let us show you how we can save you time and money, become more efficient, and add a competitive advantage as you emerge from the pandemic.

Consider Aux—let’s keep the cooperative spirit alive and the credit union industry strong! We can be reached at hello@auxteam.com or connect with us below.👇

Alan is a passionate credit union veteran, having served as Chief Marketing Officer for two different $B+ credit unions and as Director, Brand and Creative Services for CUNA Mutual Group’s TruStage brand, from its launch to its successful establishment as a leading business line. Most recently, he was CEO of Exclamation Services, a CUSO focused on helping small and medium-sized credit unions in Wisconsin compete more effectively.

Alan is recognized by the credit union industry as a visionary leader and top marketer. He has been trained through Filene’s i3 innovation program, was named one of CUNA’s annual Rock Stars, and was presented with the coveted Marketing Trailblazer award. His marketing efforts over the years have resulted in numerous CUNA Diamond marketing awards. He is a CUDE-certified industry leader, as well.