Throughout September of 2021, we conducted our quarterly survey on credit union growth to help industry executives identify trends, compare plans and pace with peers, and anticipate the future direction of industry.

The driving factor in selecting this topic for Q3 was that we’ve found that the pandemic caused many credit unions to hit the “pause” button on their growth plans. COVID-19 brought so many uncertainties that plans were put on hold and investments postponed. Now that the pandemic is well into its second year of disruption and potentially could impact plans for 2022, credit unions can only pause for so long before implementing plans for growth. The term “growth” itself may have even taken on a different meaning than it held two years ago.

We hope that this results summary provides a timely and critical report on the state of the credit union industry as we plan and budget for 2022. Summary categories include:

- Loans

- Operations

- Investments

- Mergers

- General industry trends

As many of our readers know, we conduct national industry surveys every quarter (see Q2 2021 here, Q1 2021 here and Q4 2020 here). We hope our survey results offer insight for industry leaders during pivotal economic and behavioral transitions. Below are the participant statistics for this quarter’s survey:

- Timeframe: September to October 2021

- Sample Size: 39 credit union decision makers

- Asset Range: $9.5M to $4B

- Distance span: San Francisco Bay Area, CA to Portland, ME

- Population/Population Density: 22,618/520 people per sq. mi. (Oklahoma/Texas border) to 684,500/11,500 people per sq. mi. (Central Washington, DC)

- Voting Results/Political Leanings (2020 election): Alameda County, CA (80% blue, 18% red) to Beckham County, OK (13% blue, 85% red)[1]

Aux Releases Findings from National Survey on Credit Union Growth

Executive Summary distributed October 22nd, 2021

General Industry Trends

Aux first asked what the main areas of focus for growth initiatives in Q4 2021 and 2022 were. Over 75% of respondents said, “make more loans” – no surprise there. Over 66% said, “increase new members,” while 38% said, “increase share of wallet.” Other comments focused digital and branch transformation.

Aux then asked if respondents felt that as an industry whole, are credit unions growing stronger, or weaker. 43% said stronger, 7% said weaker, and 33% said staying the same. Many left comments stating that only small credit unions are getting weaker. When asked an open-comment question on what their biggest concern surrounding growth is currently, the vast majority of respondents answered having too many deposits and not enough loans. “Excess deposits with not enough lending,” “The fight for loans and spread,” “Difficulty in growing loans,” “Too many deposits,” and “Lack of loan demand,” were just a few responses. Technology demands, regulation, and primary FI status were also mentioned.

Loans

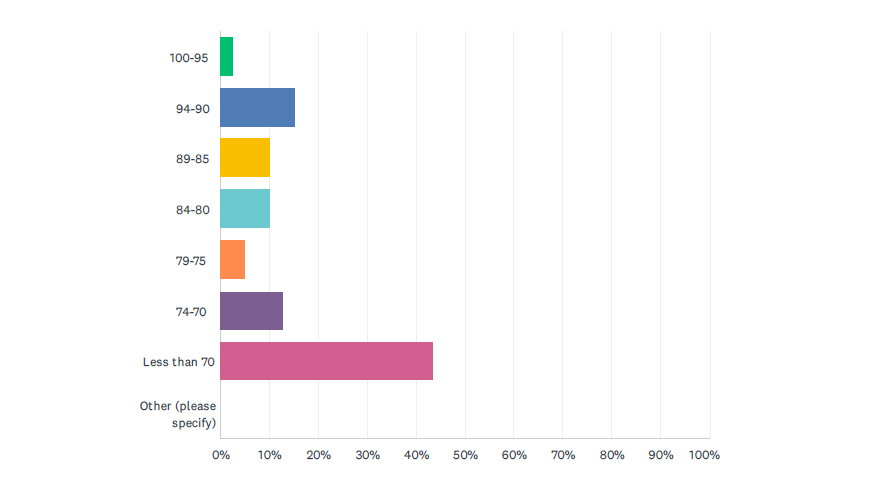

When asked what types of loans credit unions are focusing on most, auto loans were the most popular at 31%, and mortgages in second at 29%. Because an influx of deposits were made by members over the past 18 months due to stimulus money, which coincided with a lull in loans, Aux felt it would be valuable for industry executives to share their Loan to Share Ratio. Below are the results:

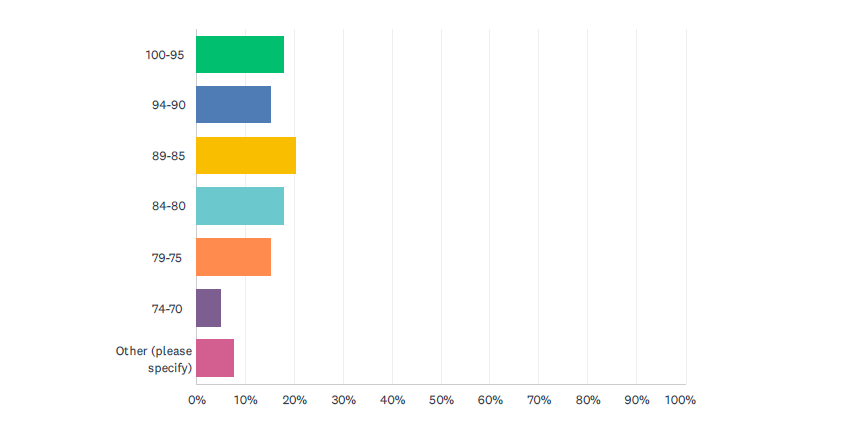

In comparison, below are the results showing respondents’ target Loan to Share ratio.

The two charts are basically reversed, illustrating the concerns and frustration surround this ratio for credit union executives. Diane Parham, Aux CFO and Head of Accounting & CFO Services for credit unions, commented, “Many of our clients are seeing strong share growth combined with a decline in loan balances. With the challenges the auto industry is facing, this phenomenon is expected to continue for the foreseeable future. Effectively managing liquidity will be the key to success for many credit unions over the coming months.”

Operations

Regarding plans for expansion, almost one-third of respondents said they are investing in member-serving technology rather than branches. On the other hand, a quarter of respondents are planning on building a new branch or multiple branches. In addition, a fifth are remodeling current branches.

Recent studies show that 40% of workers are thinking about quitting their current job. Aux asked how much respondents are concerned about potential turnover at their credit union. On a scale of -100 (not at all concerned) to 100 (very concerned), the average score was 51. The mode number was around 80, but a few selected that they were not very concerned at all, shifting the average. This question illustrates how stressed executives are regarding turnover disruption. It then made sense to ask respondents if they are implementing any changes to retain their staff. A staggering 80% are increasing pay, while a third across the board are updating HR policies, increasing benefits, and promoting internally. Other participants commented that they are implementing remote/hybrid work opportunities and improving organizational culture.

Aux asked if respondents have already experienced a change in staffing/turnover in 2021. 54% said more turnover, 30% said about the same, and 8% said less turnover. For those who have experienced more turnover, what departments were hit hardest? 84% said front line staff, and in second place, at 33% were loan departments. Least affected were compliance departments. “I think the lack of turnover in compliance is indicative of increased awareness. The complexity of compliance in 2021 demands attention and credit unions value seasoned compliance professionals. We joke that regulatory change is job security, but it’s true,” says Gaye DeCesare, VP of Compliance and Head of Compliance Services.

Aux was curious to drill down to the small credit union perspective on growth. They asked an open-comment question: “What makes it easier for large credit unions to grow and harder for small credit unions to grow?” The majority of responses centered around ability to spend, invest, and generate income: “Large CUs have bigger marketing budgets, greater economies of scale and typically more locations,” “Economies of scale. Stronger capital ratios. Less reliance on fee income,” “Large credit unions have larger efficiency ratios working in their favor, plus the largest are well known with great presence (both physical and digital). As a result, large credit unions grab market share even by doing little at times.”

Investments

In an open-comment question, Aux asked where respondents felt the best area of their credit union to currently invest in was. The responses were all over the board, so much so that it was impossible to even highlight trends. Ranging from technology, to staff, to CUSO relationships, to new branches, responses spanned the full spectrum. Up until this point in the survey, there has been a general agreement in most responses, but the topic of investments show how unique each credit union’s strategies are, even when the industry seems to be unanimous. Even segmented by size, there were no trends in responses.

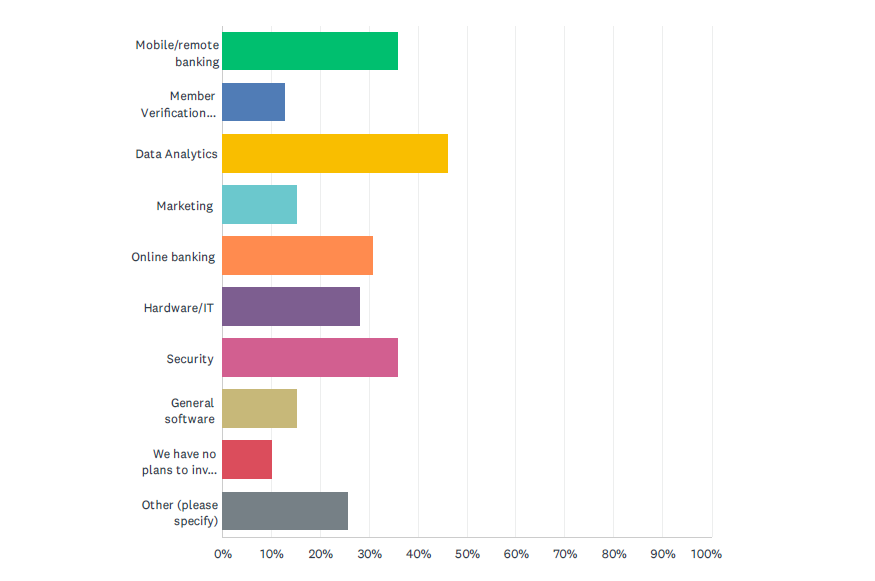

Regarding investments in technology specifically, data analytics was the most popular, with 46% of the votes. Mobile/remote banking and security were tied at 33%. Only 10% of respondents said they had no plans to invest in technology.

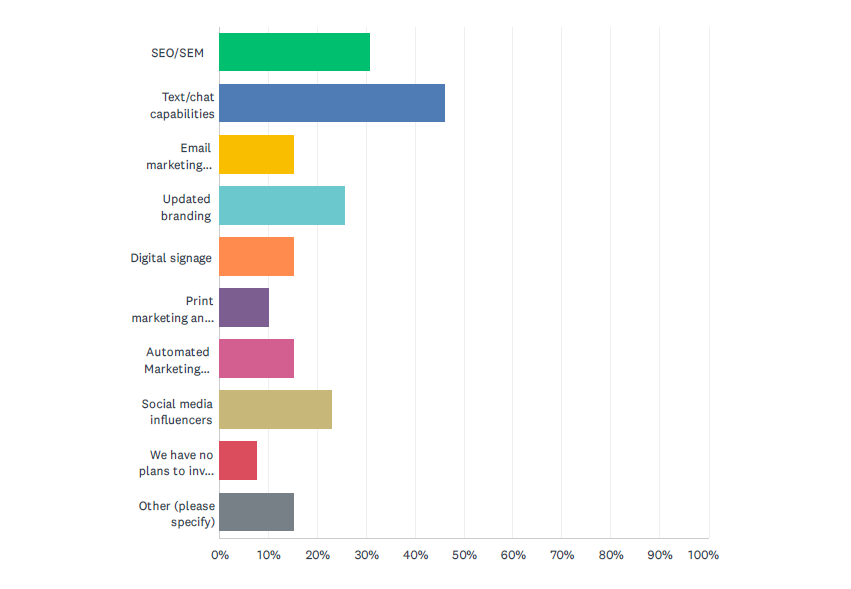

Regarding investments in marketing specifically, text/chat capabilities was most popular with 46% of the votes and SEO came in second at 30%.

The lull in mergers ended in 2020 and the credit union industry is now seeing an increase in mergers in 2021. Aux wanted to know if industry executives expect that this trend will grow or subside. On a sliding scale of -100 (less mergers) to 100 (more mergers), the average number was 47, showing that the majority of respondents feel strongly that mergers will continue to increase.

That being the case, it made sense to ask one last question surrounding mergers to wrap up the survey. Aux asked this open-comment question: “How will mergers affect the overall landscape of the credit union industry?” There appeared to be two schools of thought surrounding mergers – one positive, one negative. No surprises there, right?

The positive side focused on:

- “It will aid to better servicing, allowing more digital access and depth of service within digital. As well, improve potential slacking branch facilities and options”

- “While it looks bad to see the number of CUs in the industry shrinking, having larger institutions allows for better economies of scale to server members with more services…and larger marketing budgets/campaigns= better visibility to CUs as a whole”

- “Not much. Mostly weeding out irrelevant ones”

- “More growth…as larger CUs absorb smaller ones they gain far more opportunities and benefits for members, employees and communities than the smaller ones could on their own”

The negative side focused on:

- “The big will get bigger and the small will struggle to survive until they no longer can. The small community credit union feeling will be lost forever”

- “Credit unions may be stronger financially, but we could lose our “not a bank” perspective. If we look like a bank and walk like a bank, we could be taxed like a bank”

- “It will hurt the overall proof and perception of industry purpose and difference in mission of credit unions vs banks if all the small credit unions go away. It may lead to strength and increase in overall market share of credit unions vs banks as larger CUs better compete against banks. It will hurt the industry tax advantages, I believe, the more CUs look, act, and perform like banks”

- “Less institutions, more mega institutions”

The conversation surrounding mergers is truly fascinating. Both sides present solid points and strong arguments. If the debate around credit union mergers interests you, check out Aux VP of Sales & Marketing immersive article on the pros and cons of mergers, here.

Conclusion

Aux is committed to providing real primary-source data for the credit union industry to utilize. We believe it is part of our mission to help create a meaningful dialogue on critical issues facing the credit union movement by surfacing insights and stimulating new ideas. Every quarter, we intend to field a survey that probes and generates responses to issues that could positively or negatively impact the industry. Growth is one area that is on all credit union executives minds right now, especially as we dive into planning and budget season. And after 18 months of disruption, executives are finally starting to pull the trigger on initiatives after waiting to “see where the dust settles.” Where do you land among these results? Share your thoughts with Aux at hello@auxteam.com. Thank you for reading!